Jamie Weiss

Even those who are used to the watch industry may find it to be struggling. As Time+Tide reported in April, there was a somewhat ominous undercurrent in the clocks and the mysterious Geneva. Despite the solid slate releases at the fair, many brands are currently struggling to sell. Over the past 12 months, there have been plenty of bloodletting in Switzerland’s luxury watchmakers as they continue to fix later Covids between Trump’s tariffs (a topic of great debate on the ground in Geneva), China’s economic distress, and the overly inflated watch market.

As WatchPro reports, Swatch Group has dropped 12.2% in 2024 to Chf 6.7 billion, with Richemont’s specialist watchmaker also down 13% for the 12 months ended March 31, 2025, and LVMH’s Watch and Jewelry Group’s sales fell 3% in 2024, with privately owned Rolex “performing jewelry better than watches” not releasing financial information, but is understood to be one of the few Swiss watchmakers who are currently OK.

But around the world, Seiko, Japan’s outstanding watchmaker, has been quietly rising in sales. Seiko Group Corporation has announced that Global Watch sales increased 11.7% to 175.9 billion yen (US$1.222 billion) for the 12 months from April 2024 to March 2025. Watchpro explains that this growth was driven by a surge in international sales due to weakness in the Japanese yen, with global revenues from both Grand Seiko and Seiko increasing by around 15%, with Japan’s sales falling by 1% with Seiko and 13% with Grand Seiko.

According to Seiko Corporation, Grand Seiko, like many of the gorgeous watchmakers in its segment, is “struggling for the past two years,” but is still being tracked upwards.

“Since becoming an independent brand in 2017, Grand Seiko has been steadily growing both domestic and international sales each year,” they are linked along with their latest financial results report.

That’s something that Seiko has confidence, but there’s evidence of pudding. Since we don’t glazing more GS than we already do, we’re not surprised to hear that the brand continues to grow in sales: each year, they keep listening to their fans, providing a watch that is technically impressive, aesthetically appealing and relatively competitive. Their flagship 2025 release, UFA Ice Forest SLGB003, is iconic in this: the most accurate watch movement with a trending 37mm diameter 37mm, first ever micro-adjusted, and the main spring currently on the market is in the age of Swiss embellishment.

However, Seiko’s good fate doesn’t depend on the watch either. Late last year I wrote an article explaining that powerful watch sales are certainly driving the Seiko Group’s revenues, but it is a very diverse business with subsidiaries that do everything from operating department stores to telescopic, payment settlement, artificial intelligence and car sharing. But the points are still there. Some Swiss watchmakers have reported a decline in sales, while Seiko/Grand Seiko sales are on the rise.

But when I consider the current narrative of the (Swiss) watch industry struggling, I think there’s something worth keeping in mind. Last week, always on the side @Kingflum posted an interesting read in his Nejidown River newsletter discussing the concept of “expected debt” by bestselling author Morgan Howsel. The bottom line is that when we achieve extraordinary success, we create a psychological responsibility that we must pay back before we feel joy again.

How does this apply to the watch industry? The argument that Fulham assumes is that after years of great growth, the industry has become accustomed to massive (and read between the lines here, unsustainable) success.

“The watch industry has grown during the pandemic, and what comes with this rapid growth has been the rewiring of consumer psychology,” he argues.

“Suddenly, buying a steel sports watch wasn’t about enjoying a well-made, reliable watch, and not about making a 50-100% return overnight, sometimes overnight.

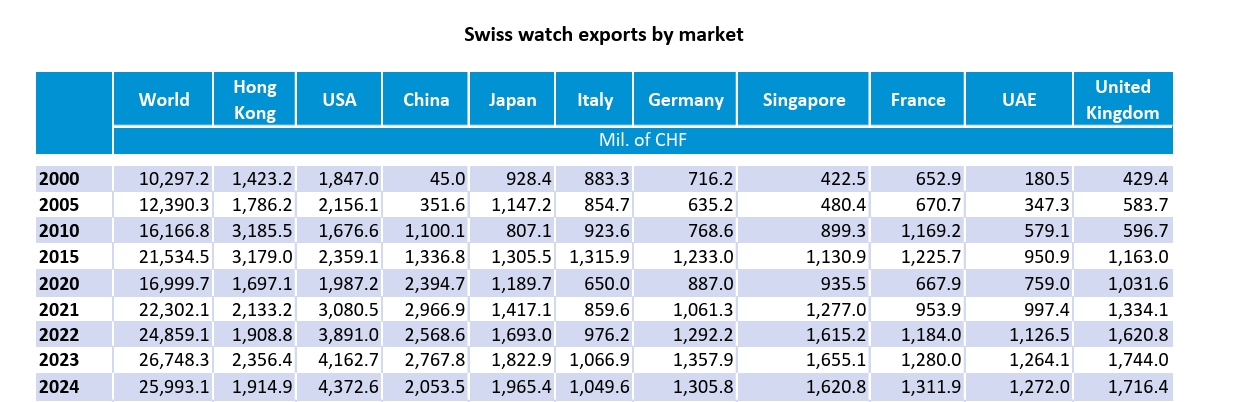

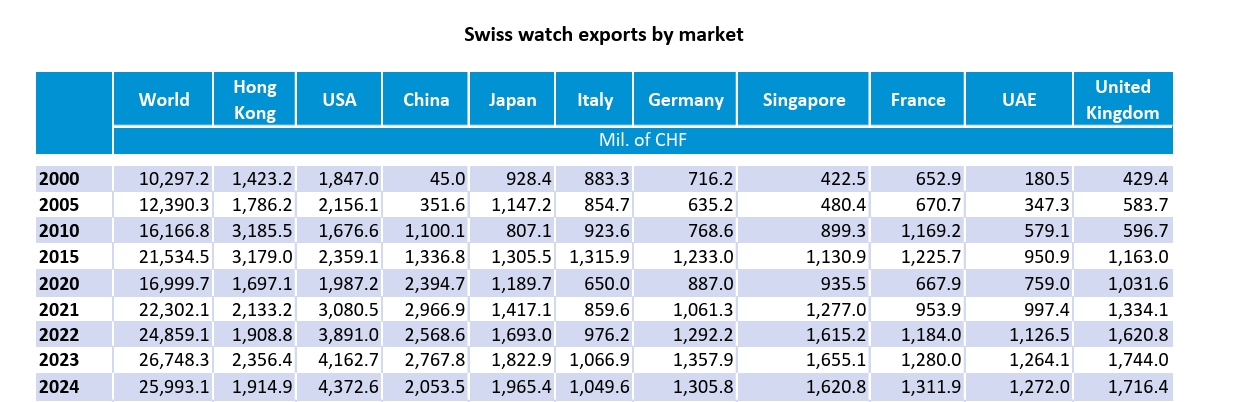

He continues, showing that things are actually very good compared to pre-2019 (or rather “pre-bubble”) levels while Swiss surveillance exports are declining. “The industry is fine with rational and historical measures.” Maybe they’ve made it better for too long, and the contractions that everyone is upset about are just going back to where things should be?

Of course, he mentions the idea of 100% returns on some watches, but the secondary market aspect is only part of the story here. When it comes to collector expectations, Fulham is spent on money, but I think that’s also the reality that only a handful of brands are actively speculated. Many people may be looking to buy Daytonas and Royal Oaks for investment purposes, but that’s probably not a big deal when it comes to Carrera and Seamaster.

Still, it is an interesting paper and certainly true to me. But time will tell – if sales continue, if mainstream interest in luxury watches continues to decline, perhaps Swiss will have something to really worry about. At the very least, they may need to monitor what is happening in Japan. If Seiko continues to sell strong, the story of the tough times will fall apart…