Buffy Acacia

If you ask someone to name a Swiss product, they will say chocolate, an army knife, or a clock. Few countries have such strong relationships with certain types of manufacturing. Not to mention watchmaking in particular. Certainly, there are heritage brands based in the UK, France, Germany and Japan, and micro-brands appear everywhere, but not set up to be successful as in Switzerland. Is there anything in the water? Or does history have an explanation? There are many factors, and none of them are insignificant.

Why did the Swiss become such a good watchmaker in the first place?

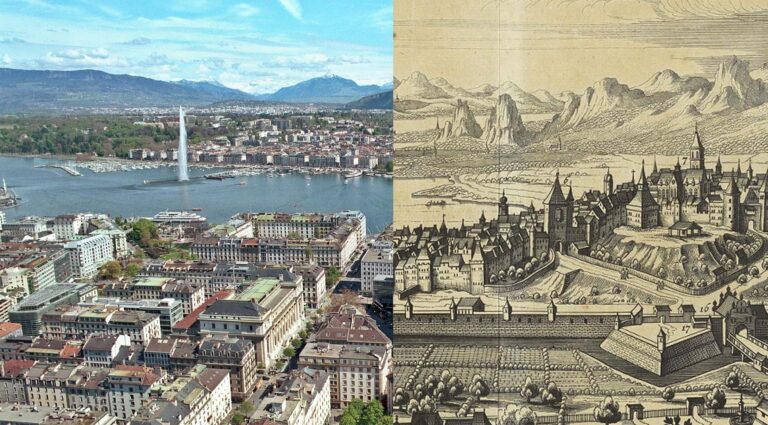

The total history of watchmaking is extremely complicated. Especially around the Middle Ages of Europe, when clock towers began to appear. The golden age of Islamic era is sometimes recognized as having many advances in mechanical engineering and mathematics involved timekeeping, but the Swiss side began in earnest in the 1500s. By that point, portable watches were still in relative infancy, either made only by a polyclimate multiparty or commissioned by wealthy nobles. The story is that when John Calvin banned the wearing of jewelry in Geneva in 1541 as part of a pure reform movement, the jeweller quickly learned how to float from French and Italian masters to make watches. Since then, the foundations for watchmaking as a co-geneva industry have been solidified.

Fast forward to the Industrial Revolution, Switzerland was uniquely placed to become a superpower in watchmaking. Individual workshops often became family business, and nearly 300 years of cumulative expertise meant that Swiss watches had a great reputation for quality. After the railway was built and workshops developed into factories, Switzerland was able to begin exports to France, Italy, Germany, the UK and even China. Certainly, perhaps the artisans of the French and British courts were making more complex and ornate objects art watches for the royal family, but they were not equally industrialized. While most of Swiss industrialisation methods were actually stolen from American companies, Switzerland allowed Swiss to surge while for some time the US was the world’s best manufacturer of pocket watches, longtime financial depression, international conflicts, and business unmanagement.

How is the Swiss watchmaking industry comparing it to other countries today?

Its short history doesn’t mean that it’s all smooth sailing for Swiss watchmaking, as Switzerland faces a significant proportion of struggles like the world economy. However, there is no doubt that Swiss watch exports are supporting the entire country. In 2021, 8.6% of all Swiss exports were watches, the third highest category, below 50.4% chemicals and drugs, and 12% mechanical and electronics. That year, the export value of the watch was 22.3 billion CHK, which rose to 26.7 billion CHK in 2022. Rolex alone counted over 10 billion. As for actual units, around 15 million watches are exported per year, half of which are mechanical.

Given these numbers, it’s a pretty hilarious concept that Switzerland has a global watchmaking competitor. The closest country to be considered a competition must be China, which exports more than 550 million watches per year. This is more than 35 times Swiss production, but China’s export value is less than five-fifths of Switzerland in 2023. That number may be shocking, but the theory is not so, given that China is a manufacturing powerhouse with a rating of quantity over quality. Please don’t get me wrong. Although China’s surveillance and general working conditions have been rapidly improving in recent years, the infrastructure and culture for luxury watchmaking is not there. The average price for one Swiss watch is $1,679, while the average price for a Chinese watch is $4.

Self-fulfilling prophecies of Switzerland’s success

Built around watchmaking, Swiss history and culture created a feedback loop of success. That first watch had a good reputation, which led to higher sales, which led to further investment in the industry, which led to better watches and more. Hypothetical arguments should not be used in place of data, but examples are useful to visualize this effect. Let’s say you are a Swiss businessman in Geneva and you have always dreamed of working for a watch company. In the unlikely scenario of the industry not having family connections, you may even have the resources to start your own brand. Calling the right person a few times will allow you to drive down the street and see exactly where your money is headed, and you can meet with designers, factories and salespeople for decades, if not centuries-old experience. Even if you are not from Switzerland, if you decide to have Switzerland make your watch, your plane ticket will get the same convenience.

Does it sound too good? Of course, it’s not that simple, but there are over 700 watchmakers in Switzerland, most of which are less than an hour’s drive from each other. They all relate to each other, allowing them to share workloads and jointly manufacture different components of the final product. It is also true that some Swiss companies outsource the actual manufacturing of cases, dials and hands from China, but it is a knowledge base that allows them to do so without encountering any major quality control issues. Another factor is the Swiss government’s deep involvement in regulating the watchmaking sector. This means that the industry is also supported by wealthy owners at the federal level. Watches, imports, imports, real estate expansion and employment are not only concerns about the brand itself, but also Switzerland’s nationally important issues.

Reliance on Switzerland, another watchmaker country

The small but optimistic community is a revived British watchmaking world. The British Watch and Watchmaking Association was founded in 2020 and currently has 105 members, but before that, there has been not much of a large industry since Smith closed in the 1970s. There is momentum, but there is not enough demand to ensure the construction of the industrial surveillance sector when it exists in Switzerland. Many of the UK’s biggest watchmaker names, including Bremont, Christopher Ward, and Fear, rely on Switzerland and China, whether based in the UK, and making some parts locally. Not everyone can become Roger Smith, they make 12 watches a year with their hands.

If we’re talking about France, you’re probably talking about Swiss too. Cartier and Belle & Ross are two French brands made entirely in Switzerland, with other smaller brands like the Baltic Sea and lips using Chinese, Japanese, or Swiss movements at their final French conventions. Even Yema, one of France’s most proud brands, recently announced that its flagship Superman Diver will be made in Switzerland (cases and dials were already in production). Certainly there is a larger cultural precedent for French independent luxury watchmakers, leading to the likes of Remi Coeurs, Recommete, and Theréo Auffret.

Germany is an interesting case. Because while numbers and Swiss values are not close to China, the watch industry is mentally quite close to Switzerland. It is packed into a black forest area south of Stuttgart and north of the Swiss border. The Junghans are once a huge watchmaker known for the legend of the Bauhaus in the small town of Schlanberg, where the icons of the voices of pilots Lako and Swar are found in Pforzheim. Still, these brands tend to use Swiss movements. Glashütte is the place where “pure” German watchmaking takes place in Saxony, with a relative distance from Switzerland being A. It may explain why Lange & Söhne, Glashütte Original, Union Glashütte, Nomos Glashütte and others create their own in-house movements. Glashütte itself has much stricter laws on how many watches you need to make locally to get a name on the dial. That’s why there’s a lot of local pride. Still, it’s just a small town with only a handful of brands, so it’s more like a watchmaking micronation than a Swiss rival.

Naturally, you may be wondering about Japan. Seiko, Citizen and Casio are some of the most popular watch brands in the world. Casio in particular sells more units each year than any other watch brand. However, in 2023, Japan’s 49.9 million watches exported to just USD 1.87 billion. It is true that Japan is a globally speaking watchmaking powerhouse, but it is an industry dominated by just a vertically integrated company that (almost) produces affordable watches. The brand may easily buy budget-friendly moves from Seiko or Citizen (aka Miyota), but the other opportunities are pretty bleak. Of course, Japan has a considerable portion of small artisan brands such as Tokyo Gishi, Minase and Nakagawa Kiyoshi, but they are not moving on their own. Things like kikuno Island, Ohara, Shirota Daido and Nagata Hida certainly charge the right amount.